Is 2026 the Year to Buy a Unit in Liverpool LGA? Insights for First Home Buyers

With a buzzing property market and government incentives, many first home buyers are wondering if now’s the time to buy a unit in the Liverpool Local Government Area (LGA) taking advantage of lower deposits of 5%.

National Trends and Liverpool’s Growth

In a Australian Bureau of Statistics (ABS) September 2025 report released this week (Mon 3rd November), a 7.0% rise in dwelling approvals nationwide is reported, driven by a 30.6% increase in private sector apartments, with NSW at the forefront. This trend towards high-density housing is evident in Liverpool, a fast-growing hub in Sydney’s southwest. Major projects like the Western Sydney International Airport and Aerotropolis, alongside Liverpool City Council’s focus on density in Liverpool CBD and Edmondson Park, are driving economic and residential growth .

Recent data shows Liverpool’s median unit price at $585,000 in Q1 2025 (versus $1,100,000 for houses), making it extremely affordable in comparison and earning it the rank of #1 in NSW for first-home buyer sales (see references link below).

With 189 units listed in Liverpool and 32 in Edmondson Park at the time of writing, buyers currently have some great options .

First Home Buyer Incentives

The NSW Government’s First Home Buyer Assistance Scheme offers a 5% deposit option, alongside covering Lenders Mortgage Insurance (LMI), plus stamp duty exemptions.

These lower entry barriers make 2026 an accessible time to buy in Liverpool, although remember LMI protects the lender, not you, and lending criteria to your loan still applies .

Unit Price Trends and Market Outlook

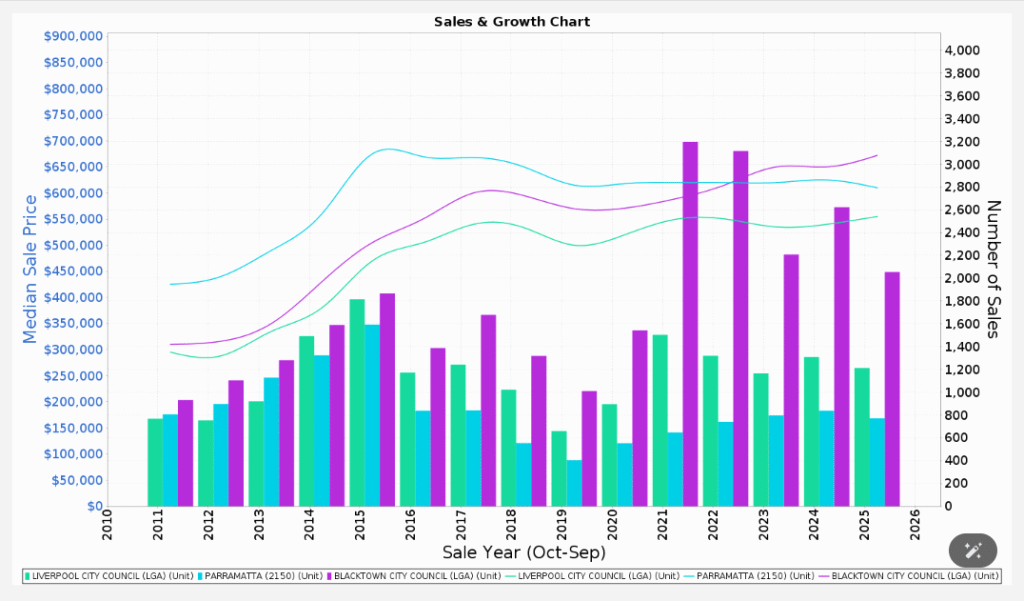

Comparing Liverpool to nearby areas provides context. In Parramatta CBD, unit prices stagnated during high-supply years (2016-2018) but grew with infrastructure like the Light Rail. Similarly, Blacktown’s 2025 supply increase softened prices by 3-5%, yet future projects signal recovery.

In Liverpool, current approvals may temporarily ease unit prices, but a projected price jump by 2026 due to infrastructure suggests strong long-term potential for buyers .

Make A Great Decision.

Challenges of Unit Ownership

Buying a unit has considerations for first home buyers:

- Strata Costs: Quarterly fees vary and can strain budgets, alongside maintenance risks.

- Construction Quality: Poor builds can lead to costly issues.

- Growth and Yield: Units often appreciate slower than houses, and rental yields may be less competitive, though Liverpool’s demand offers balance .

- Fluctuating Prices: When many contruction projects finish at the same time, developers can sometimes compete to sell their units which can have a short term effect on the market.

Should You Buy a Unit in Liverpool LGA in 2026?

- Advantages: Incentives, a median unit price of $585,000, and Liverpool’s top ranking for first-home buyers make now appealing.

- Risks: Strata fees, short-term price stagnation from supply, and quality concerns need caution and due diligence.

- My Advice: If you’ve got a stable financial plan and a medium to long-term view, buying in growth areas like Liverpool and avoiding the rent trap can make sense. If costs worry you, save more while renting but be mindful that weekly rents increasing are largerly connected to increased ownership costs.

Let’s Discuss Your Property Goals

As your local agent, I’m ready to guide you through Liverpool’s market. Contact me at 0422 333 33 for a personalised chat about buying or selling a unit in Liverpool LGA.

Useful Resources for Liverpool Buyers

| Resource | Link | What It’s For |

|---|---|---|

| Liverpool City Council | www.liverpool.nsw.gov.au | Development plans and updates |

| ABS | www.abs.gov.au | Housing statistics |

| NSW First Home Buyer Info | www.nsw.gov.au/housing-and-construction | Incentive details |

| Domain Market Insights | www.domain.com.au | Listings and trends |

Have questions? Reach out—I’m keen to help you take action.